Social Security Offers Benefits from Birth Through Old Age

The bulk of Social Security benefits go to retirees, but Social Security is much more than a retirement program. Most Americans are protected by the Old-Age, Survivors, and Disability Insurance (OASDI) program — the official name of Social Security — throughout their lives.

At the Beginning of Your Career

Your first experience with Social Security might be noticing that Federal Insurance Contributions Act (FICA) taxes have been taken out of your paycheck. Most jobs are covered by Social Security, and your employer is required to withhold payroll taxes to help fund Social Security and Medicare.

Although most people don’t like to pay taxes, when you work and pay FICA taxes, you earn Social Security credits. These enable you (and your eligible family members) to qualify for Social Security retirement, disability, and survivor benefits. Most people need 40 credits (equivalent to 10 years of work) to be eligible for Social Security retirement benefits, but fewer credits may be needed for disability or survivor benefits.

If You Become Disabled

Disability can strike anyone at any time. Research shows that one in four of today’s 20-year-olds will become disabled before reaching full retirement age.1

Social Security disability benefits can replace part of your income if you have a severe physical or mental impairment that prevents you from working. Your disability generally must be expected to last at least a year or result in death.

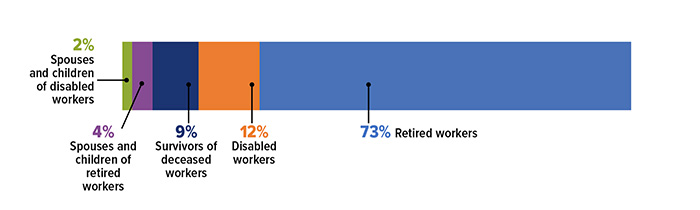

Current Social Security Beneficiaries

Source: Social Security Administration, 2023

When You Marry...or Divorce

Married couples may be eligible for Social Security benefits based on their own earnings or on their spouse’s.

When you receive or are eligible for retirement or disability benefits, your spouse who is age 62 or older may also be able to receive benefits based on your earnings if you’ve been married at least a year. A younger spouse may be able to receive benefits if he or she is caring for a child under age 16 or disabled before age 22 who is receiving benefits based on your earnings.

If you were to die, your spouse may be eligible for survivor benefits based on your earnings. Regardless of age, your spouse who has not remarried may receive benefits if caring for your child who is under age 16 or disabled before age 22 and entitled to receive benefits based on your earnings. At age 60 or older (50 or older if disabled), your spouse may be able to receive a survivor benefit even if not caring for a child.

If you divorce and your marriage lasted at least 10 years, your former unmarried spouse may be entitled to retirement, disability, or survivor benefits based on your earnings.

When You Welcome a Child

Your child may be eligible for Social Security if you are receiving retirement or disability benefits, and may receive survivor benefits in the event of your death. In fact, according to the Social Security Administration, 98% of children could get benefits if a working parent dies.2 Your child must be unmarried and under age 18 (19 if a full-time elementary or secondary school student) or age 18 or older with a disability that began before age 22.

At the End of Your Career

Social Security is a vital source of retirement income. The benefit you receive will be based on your lifetime earnings and the age at which you begin receiving benefits. You can get an estimate of your future Social Security benefits by signing up for a my Social Security account at socialsecurity.gov to view your personal Social Security statement. Visit this website, too, to get more information about specific benefit eligibility requirements, only some of which are covered here.